If you’ve been wanting to use Square as your credit card payment processor in Kartra, now you can.

This is an alternative to the most often used Stripe, or Authorize.net or Braintree.

If you don’t already have an account, you can sign up for the Square service and receive $1,000 in free processing by using my link here: https://squareup.com/i/3B2FF75AE8 (affiliate link)

In order to integrate with Square, you will want to click My Integrations, then go to Square.

You want to click the three dots under the “Square” logo and select “Create Integration”.

In the pop up select “Connect Square” and you will be taken to a separate window on the Square website. Follow the on screen instructions from the Square website to provide permission for Kartra to integrate with their service.

*Note: These permissions are all required and you cannot “Deny” them unless you do not want to integrate Square.

Afterwards you should be redirected back to Kartra and now your Square service should be a valid credit card option within Kartra!

*Please Note: There are some additional things that are different from a typical payment gateway setup but are standard for Square.

Your customers who visit your checkout will now see a new checkbox unique to Square checkouts: “Save my credit card for future use”

Other checkout services can store the customer’s credit card information via the payment processor to allow easy re-use of their information for up-sale or future purchases. But Square in particular must ask permission for this information from the customer which is why there’s an additional checkbox option.

When your client checks the box, an email will be sent to them asking permission to store the credit card information; similar to a double opt-in process for email.

This is a standard behavior with Square and has no customization options. This feature cannot be removed, altered, or changed in any way as long as Square is being utilized.

So – why would you want to switch to Square if you’ve been using Stripe for your credit card processing with Kartra up until now?

|

Hi Danielle, We are writing to inform you of an upcoming change to the Square refund policy, as well as updates to Square’s Terms of Service, all of which will be effective as of April 11, 2023. Occasionally, we update our policies and pricing for our products to better align to evolving costs from our network and payments partners. In these scenarios, we make pricing changes so that we can invest in our platform, create new features, and continue expanding the value Square provides to sellers like you. Processing fees will no longer be refunded to your account when you issue full or partial refunds to your customers. We are making this change to reflect that Square incurs processing fees from our network and payments partners in instances of refunds, and to match current industry standards. You do not need to take any action and there will be no change in the experience for your customer. |

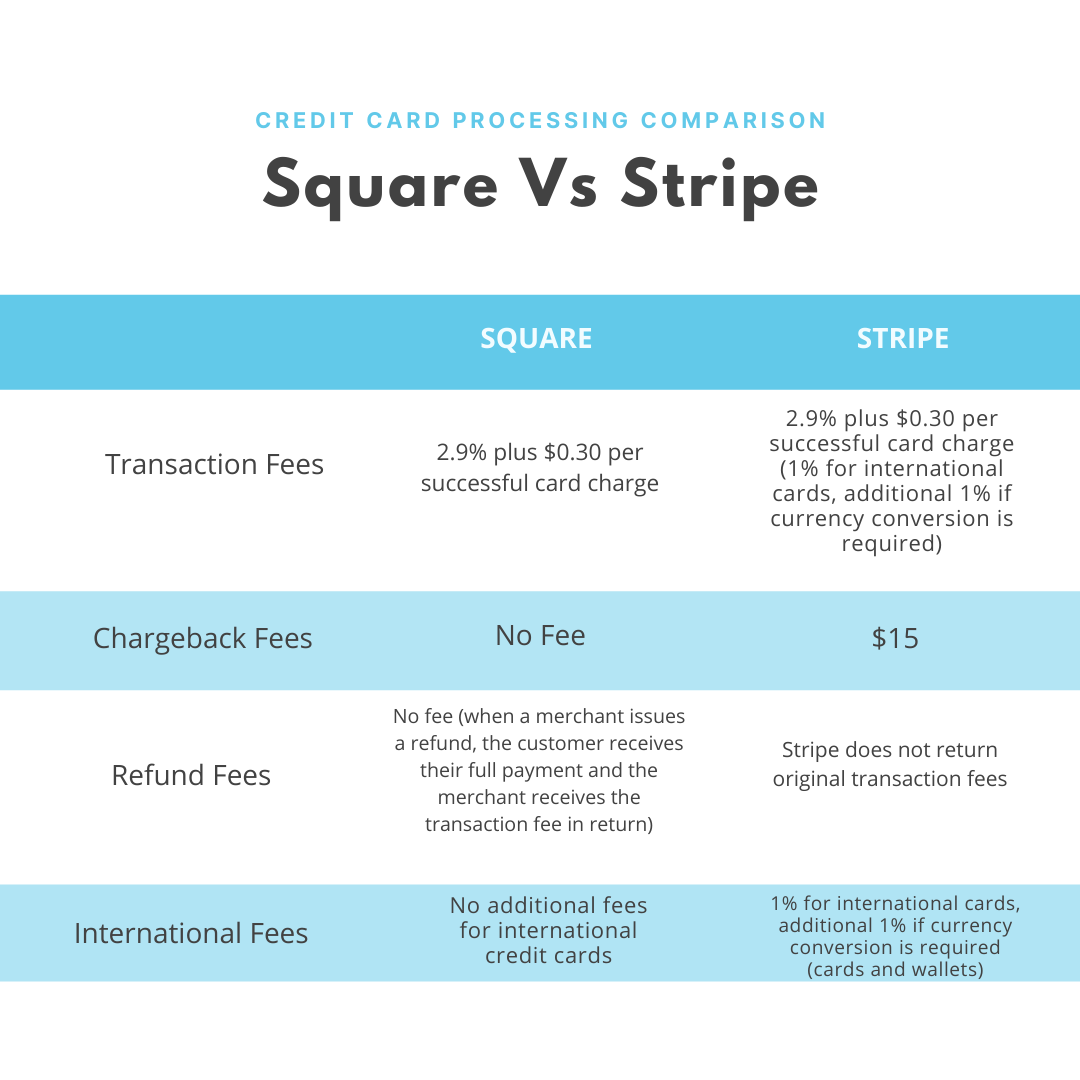

For transactions processed through Kartra, both Square and Stripe charge a 2.9% fee plus 30 cents per transaction.

But there are additional fees to be aware of —Stripe charges merchants a $15 fee for chargebacks, while Square does not have chargeback fees.

Additionally, Stripe charges an extra 1% for international transactions and an additional 1% for if currency conversion is required, while Square does not.

Finally, as of April 11, 2023, neither Square nor Stripe refund processing fees when you refund a transaction. 🙁

If you frequently issue refunds or process international transactions, you’ll want to factor in these additional charges, and consider Square as the best option.

Need-to-Know Facts About Square’s Payment Processing Fees

-

No hidden fees! There are no fees for:

-

Activation

-

Chargebacks and Dispute management

-

Square Support

-

Refunds

-

Advanced reporting tools

-

Account inactivity

-

PCI compliance PCI compliance coverage

-

Account takeover protection

-

End-to-end encrypted payments

-

Active fraud prevention

-

Next-business-day transfers

-

Free Square Reader for magstripe

-

Early termination

-

-

Credit card fees are included in Square’s fees, so there are no charges from credit card companies.

-

Every card brand accepted has the same rate.

If you process a lot of refunds (which sometimes happens with upgrades and such) or a lot of international transactions, switching to Square could make for a big impact on your bottom line.

But on the other hand, if you have a lot of membership products or payment plans, the second step of clicking the checkbox for recurring transactions could be a deterrent and affect your conversions.

Which am I using now? Do I use Square or Stripe?

When Square first became available as an option for credit card processing in Kartra, I jumped in and tested it out.

I have used Square in previous businesses and find it easy to work with, and I liked the idea of having less fees for processing international transactions and being refunded processing fees for refunded transactions.

However, I found that I had more issues (blocked transactions and such, with repeat clients, even) with transactions when using Square vs. Stripe (that couldn’t 100% be tracked back to Square as a problem, but when I switched back to Stripe I no longer had those issues so there’s that).

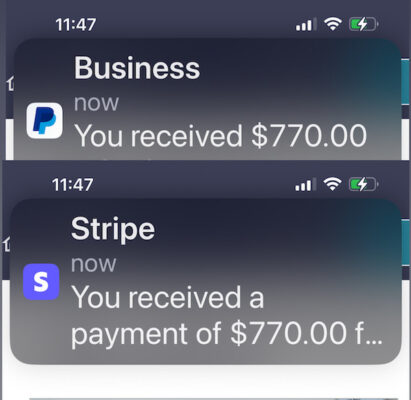

And with the way that the Kartra/Square integration works, transactions don’t show up as notifications via the Square app. Meaning no email or app notification when a payment goes through.

I am a big, big, big fan of watching payment notifications pop up on my phone via the Stripe and PayPal apps…

(Oh, those last minute transactions before a midnight deadline on a limited time offer…💰 ⏳)

So even though it may not be a deal-breaker for some, it definitely weighed heavily into my decision process. I like (almost) everything about my business to be enjoyable, and the lack of these notifications really dampened the vibe.

With those two factors I went back to using Stripe fairly quickly.

I was a little bummed because I do have quite a few international clients and was looking forward to saving 1% on those transactions.

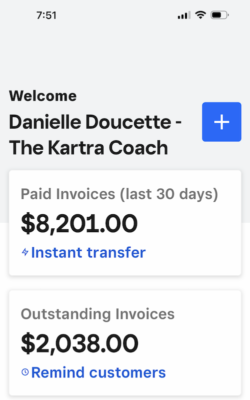

But I did switch my biggest two group coaching clients over to being invoiced via Square – and since one of them is Canadian and the invoices are quite big, that made a significant impact on what I was paying in fees, which I’m happy about. And turns out I love Square’s invoicing features.

So bottom line…I am not using Square as my payment processor with Kartra but I am using it for invoicing and it is such a good fit for that!

If you don’t yet have a Square account and would like to get started with $1,000 of transactions processed with zero fees, here’s my referral link! https://squareup.com/i/3B2FF75AE8

Which one will you be choosing as your credit card processor in Kartra, Square or Stripe? Let me know in the comments!

Since I share marketing strategies with awesome people like you, naturally my content may contain affiliate links for products I use and love. If you take action (i.e. subscribe, make a purchase) after clicking one of these links, I will receive an affiliate commission at no extra cost to you. In this case, if you use my link, we will both get $1,000 of processed transactions without any fees – yippee!!!!